A Study on the Relationship between Capital Structure and ProfitabilityBased on the Empirical Data of Listed Companies in Cultural Media Industry in China

Keywords: Cultural Media, Capital Structure, Linear Regression

Abstract.This paper chooses the listed companies in cultural media industry as the subject, selects 23 listed companies as the sample, utilizes the finical data during the period of 2002 and 2011 and employs the principal component analysis and linear regression methods to carry on an empirical research on the relationship between capital structure and profitability of the listed companies in cultural media industry. The research results show that the asset-liability ratio and profitability have significantly negative correlated relationship, and shareholdersrsquo; equity ratio has significantly positive correlated relationship with profitability, however, the relationship between liquidity ratios and profitability is not significant. Therefore, optimizing the capital structure can be recognized as an important way to improve the capability of listed companies in cultural media industry.

Introduction

In 1958, Modigliani and Miller published The Cost of Capital,Corporate Finance and The Theory of Investment which carries on the pioneering research of the relationship between the cost of capital and the values enterprises. Since then the scholars at home and abroad have successively made plenty of theoretical and empirical researches on the related questions of capital structure on the basis of their theory. As an emerging industry, culture media industry has met a leap type development with the support of national policy in recent years. Although it develops with prosperity, a number of problems have been exposed in the cultural media industry such as the companies have met financing bottleneck and the earnings growth has slowed down. Therefore, under this background it is necessary to make researches on the relationship between capital structure and profitability, which will assist companies to optimize the capital structure of listed companies in cultural media industry, solve the problems of financing bottleneck and improve the profitability of the company.

Relate Research Basis

There are plenty of studies of the relationship between capital structure and profitability abroad, but no unified conclusion has been made. Most of the scholars believe that the capital structure has significant positive correlated relationship with profitability. Scholars like Frank and Goyal. Some scholars insist that there is a significant negative correlated relationship between these two factors. As an example Booth etc. Domestic studies on relationship between capital structure and profitability started relatively late, and the conclusions are not always the same. Most of the scholars have concluded that capital structure has a significantly negative correlated relationship with profitability. For example Bin Cheng, Wang Bin and Mao Xiaofei, Wang Jingjing and Li Chun Hui etc. However, there are some scholars concluded that the capital structure has a significant positive correlated relationship with profitability. For example Li Gengyin and Yang Ling. In addition, there are some scholars who put forward the point of view that in different industry, the relationship between capital structure and profitability are different. For instance, Gao Guowei. Throughout the domestic and foreign literatures, the author found that there is a correlated relationship between capital structure and profitability, and which is widely recognized point of view.However, the relationship between these two factors has presented very different states because of the different social environments, different research objects and different influencing factors. Therefore,during the process of empirical researches, we should make a dialectical analysis of the research subjects themselves on the basis of the basic theory of capital structure and put forward the corresponding rational suggestions for the sake of improving the theoretical and empirical values of the research.

Research Method

Sample Selection and Data Source. This article selects 23 companies in cultural and media industry which have gone listed before 2010 as samples and it takes the financial indicators of the above mentioned listed companies from 2002 to 2011 as sample data. Data is collected from the financial reports of Shenzhen Stock Exchange and Shanghai Stock Exchange, Great Wisdom Software, Flush Software, Stockstar.com and Hexun.com.

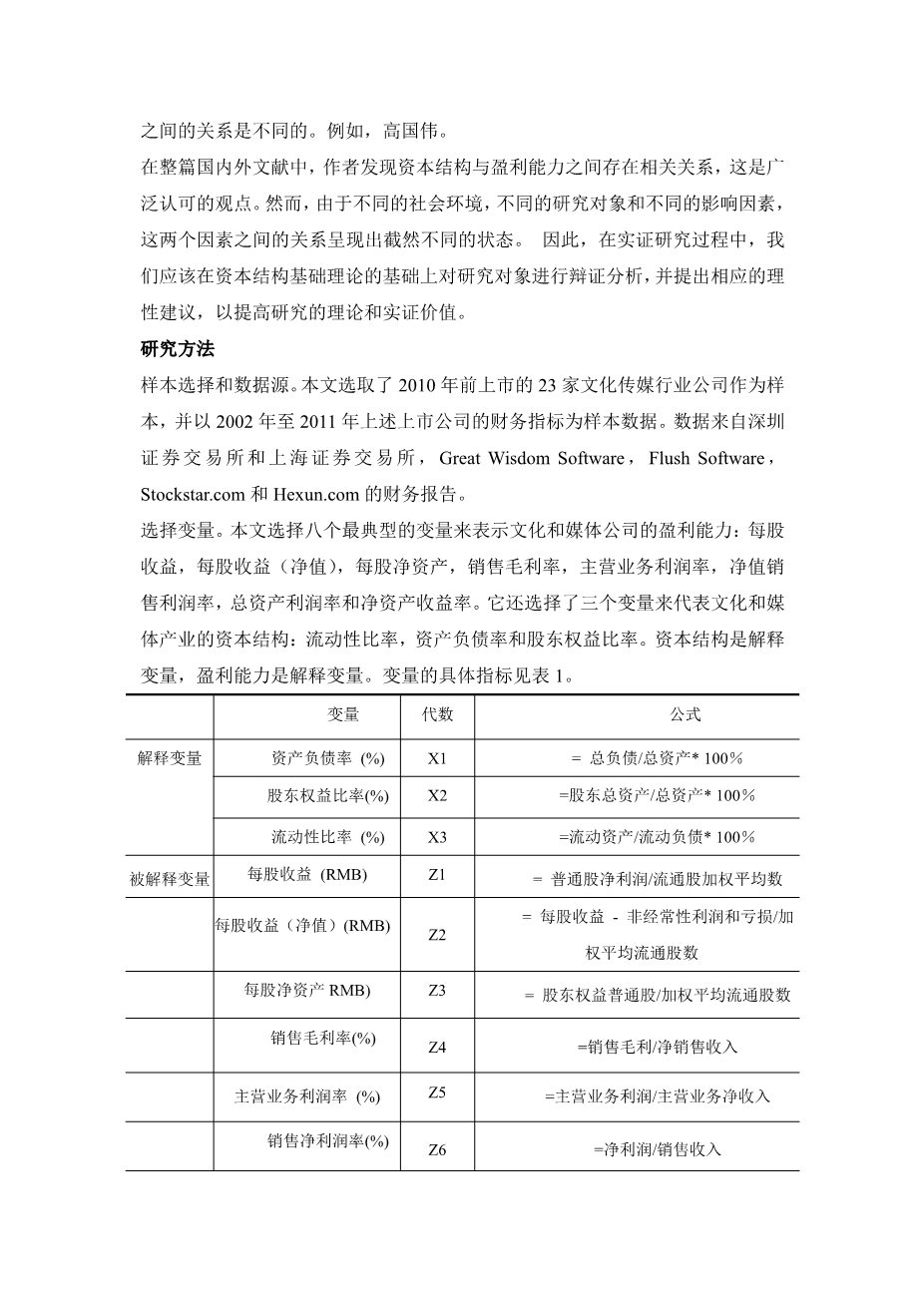

Selection of Variables.This article selects eight most typical variables to represent the

profitability of cultural and media company: earning per share, earning per share (net), net assets per share, gross profit margin of sales, profit margin of main business, net profit margin of sales, profit margin of total assets and rate of return of net assets. It also selects three variables to represent the capital structure of cultural and media industry: liquidity ratio, asset-liability ratio and shareholders equity ratio. The capital structure is the explanatory variable and profitability is the explained variable. Specific indicators of variables are shown in table 1.

Table 1 Selection of variables

|

variables |

code |

formula |

|

|

explanatory variables |

asset-liability ratio (%) |

X1 |

= total liability/total assets*100% |

|

shareholders equity ratio (%) |

X2 |

= total equity of stockholders/total assets*100% |

|

|

liquidity ratio (%) |

X3 |

= liquid assets/liquid liability*100% |

|

|

explained vari 剩余内容已隐藏,支付完成后下载完整资料

英语译文共 7 页,剩余内容已隐藏,支付完成后下载完整资料 资料编号:[609718],资料为PDF文档或Word文档,PDF文档可免费转换为Word |

以上是毕业论文外文翻译,课题毕业论文、任务书、文献综述、开题报告、程序设计、图纸设计等资料可联系客服协助查找。